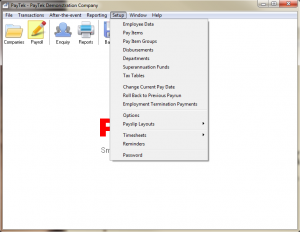

Employee data

This section allows you to set up new employees, and to edit details of existing employees. It is dealt with in detail in Section 3 — Setting-up your Payroll.

Pay items

This section allows you to add or edit pay items. It is dealt with in detail in Section 3 — Setting-up your Payroll.

Pay Item Groups

Pay item groups are used for custom reporting, superannuation calculations and leave accrual calculations. Simply nominate what pay items are included in each group. Then when you set up a leave accrual or a custom report or superannuation fund you can specify which pay item group to use for the calculations. For example if you create a pay item group called “Superannuation” and include ordinary hours and annual leave and sick leave then the superannuation reports will calculate the superannuation on only those pay items.

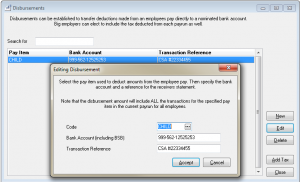

Disbursements

This feature can be used to remit payments to a nominated bank account for deductions made from an employee’s pay. The amounts are included in the EFT file created for employees paid by bank transfer.

As an example Johan Dennis has $60 deducted for child support each week. A pay item is created for this deduction. It is added to the disbursements file with the bank account and his reference for the receiving entity.

NOTE if multiple employees had child support garnisheed you should create a pay item for each to enable a unique reference for the transfers.

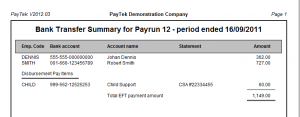

When the deduction is made you will see that it is added to the bank transfer summary for the payrun and will be included in the EFT file.

Here we have created a disbursement for the CHILD pay item created for Johan’s child support payment.

We deduct the prescribed amount from Johan’s after tax pay amount.

The amount deducted is transferred to the EFT file with the employee pay amounts.

Departments

Enter a list of departments for your employees. This enables you to subtotal the following reports by department.

- Year to date employee pay report

- Accrual reports

- Superannuation Guarantee costing report

Superannuation funds

Enter the superannuation funds that you pay the Superannuation Guarantee Levy to on behalf of your employees. As at July 1, 2015 the ATO percentage is 9.5%. In addition you do not have to pay the superannuation levy for an employee who earns less than $450 in a month. There is also a quarterly maximum above which you do not have to pay the levy. Check with the ATO for the current amounts.

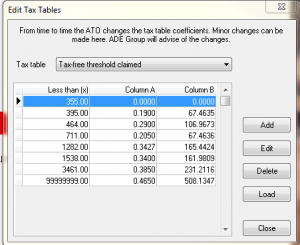

Tax tables

This option enables you to edit the tax tables used to calculate the withholding tax amount deducted from employees’ pays. These tables are altered by the Tax Office from time to time, and as a registered employer, you should be notified of any changes by the Tax Office.

ADE Group will supply updated data files to all members of the PayTek Support Program, obviating the need to perform manual tax table edits.

There is also a HELP (Higher Education Loan Program) table, which is provided by the Tax Office for calculating the HELP amount that is added to tax deducted from a HELP-affected employee’s pay.

There is also an SFSS (Student Financial Supplement Scheme) table, which is provided by the Tax Office for calculating the SFSS amount that is added to tax deducted from a SFSS-affected employee’s pay.

If appropriate, you can also establish a user-defined tax table to apply against an employees pay. Note that you can also specify a flat rate of tax for each employee in their setup.

Load tax tables

This option allows you to update the tax tables being used by the current payroll with the latest tables supplied with the last PayTek upgrade. Note that upgrading the program does not automatically update the tax tables for each payroll file — whenever there is a tax rate change, you will need to select this option to update

the tables before commencing the pay run.

Change Current Pay Date

Although the next pay period end date is calculated automatically, you may override this if necessary. Any date in the current financial year can be used but consider the effect on your reports etc if you process a payrun before the last finalised payrun date.

The main reason to edit the pay date would be to run an adjusting payrun to correct an employees payrun details. If you do this make sure you set the next normal payrun date back to the correct period end.

Roll back to previous payrun

If you finalise a payrun then discover an error you can unfinalise the payrun. Note that you will lose all the data in the current payrun, as it will be overwritten with the previous payrun data. If you do ever unfinalise the payrun consider the effect of any reports/payslips already distributed and any payments made. The alternative is to create an “adjusting” payrun on the same date to correct the error.

Employment Termination Payments

This option can be used to correct a previously entered Employment Termination Payment. You can delete it then enter it again in the current payrun or as part of an adjusting payrun.

Options

This takes you into the System Setup section, much of which is discussed in detail in Section 3 — Setting-up your Payroll.

Payslip Layouts

If necessary you can edit the payslip layout and change the position of various fields on the payslip. PayTek uses the FastReports© report designer to modify the layout file. This is a programmer’s tool that is very powerful and therefore quite complex. Check with PayTek Support for more information on the Rave Designer.

Timesheets – Public Holidays

If you are using the timesheet feature you can create a file of public holidays that will be highlighted when entering timesheets. This is useful if you have to pay penalty rates on such days (Weekends are highlighted by default).

Timesheets – Defaults

If you are using the timesheet feature you can specify some defaults when entering timesheet information. This includes a default start and finish time and a break duration. Also you can include the weekend days when loading the default timesheet records and nominate a default pay item.

The description format is used when transferring details timesheet records to the employee’s pay. Use %s as a placemarker for the date, then start time then finish time then duration of break. (The last 3 items will appear in hh:mm format)

Reminders

Enter a list of reminders that will be displayed each time you open the payroll company file. In addition you can nominate to include birthdays and employment anniversaries on the reminders list. This can be useful for junior employees who receive pay increases as they get older or more experienced.

Password

You can password protect your files by entering a password here. The password applies to the current company file. When you set a password, you will be prompted to enter it every time you load the company file.

Hide toolbar

You can hide the toolbar of speed buttons at the top of the main PayTek screen. This is useful to allow more screen space for viewing reports or transaction lists. It toggles on and off.