Superannuation for Under 18s and Domestic Workers

From July 2022 you are required to pay superannuation on wages paid to employees who are under 18 or employed as domestic workers ( maids, nannies etc) if they work 30 hours or more in any week.

Paytek can assist you in meeting this obligation. Since Paytek does not require you to enter daily timesheet information, it will alert you about the threshhold so you can adjust the pay.

If you employ under 18s or domestic workers you should:

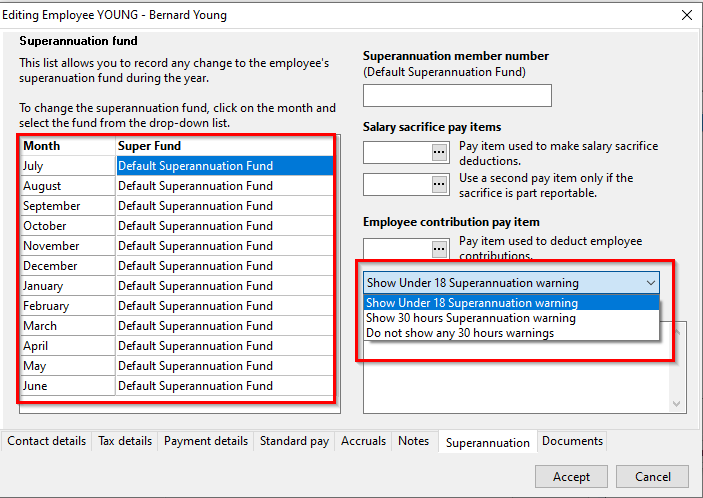

1. Enter and link them to their superannuation fund. Domestic workers are not subject to the age limit so you can specify to show the warning for them regardless of age.

Also if you pay the super regardless of the hours you can suppress the warning for the under 18 employee.

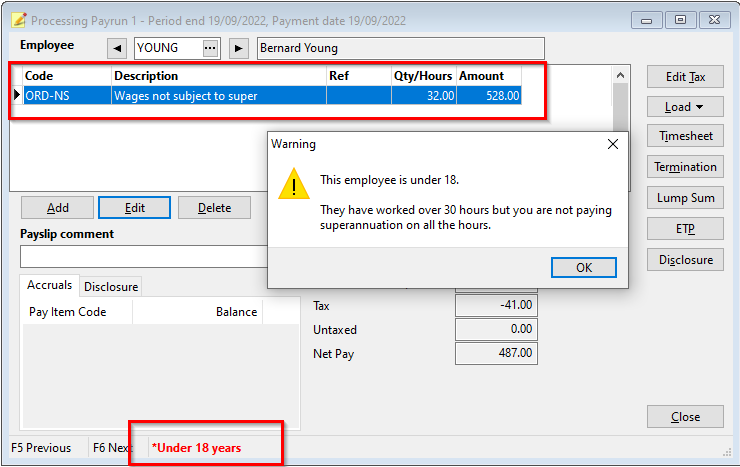

2. If they usually work under 30 hours pay them using a pay item that IS NOT subject to superannuation (ie not a member of your superannuation pay item group used in the calculation)

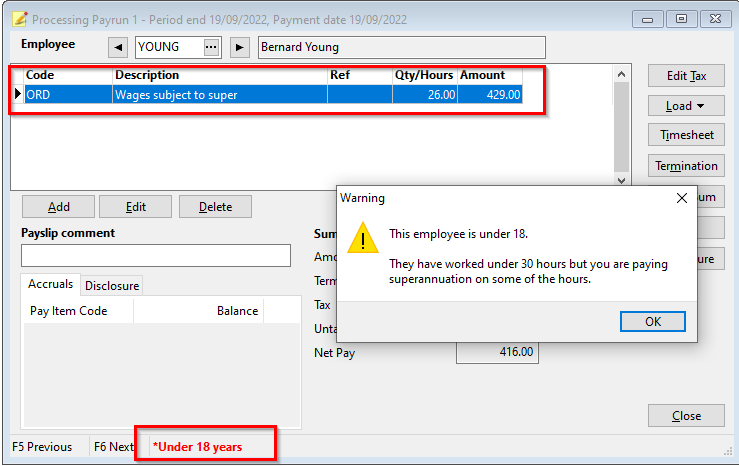

If they usually work over 30 hours pay them using a pay item that IS subject to superannuation (ie not a member of your superannuation pay item group used in the calculation)

This will ensure that if you have paid them over or under the 30 hours threshold Paytek will provide the appropriate warning.

This will allow you to use the appropriate pay item for the hours they worked in the week.

(It is necessary to change the pay item as each pay item must is either included or excluded from the superannuation calculation)

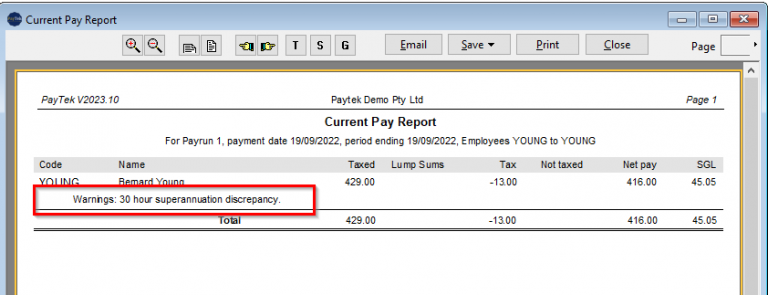

3. When you print the current pay report it will show a warning if the hours paid for each pay item conflict with the the 30 hours threshold.

For more information about this rule please refer to this webpage.

NOTES

1. When the employee turns 18 you should pay them using the normal pay items as the 30 hour threshold does not apply.

2. If you pay fortnightly Paytek will show the 30 hour warning but you will have to assess the weekly split and adjust the pay items accordingly.