12. Single Touch Payroll

Single touch payroll is an initiative mandated by the ATO whereby your payroll data must be lodged with them electronically each payrun.

This chapter will explain how to activate and process single touch in Paytek.

Each time you finalise a payrun in PayTek you have to send the ATO a “pay event”. This comprises

-

The total wages and total tax withheld in that payrun

-

The complete payment summary information YTD for each employee who has been paid in the financial year (as well as your total superannuation liability for each employee paid)

-

Optionally a Tax File Declaration for each new employee staring in the payrun

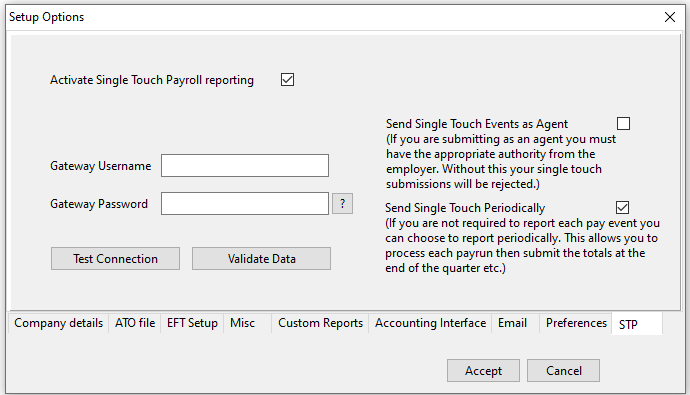

STP Activation

This is the setup screen for STP. Tick the activate box and enter your gateway username and password supplied by ADE Group.

By default Paytek requires you to send each payrun to Single Touch when you finalise it. If you are permitted to report quarterly you can elect to send to Single Touch periodically. This allows you to process payruns and skip sending them. When you finalise your last payrun for the quarter you can send it to single touch. This will send the accumulated totals in your pay event (as well as the YTD amounts for each employee as normal)

If you are a payroll service provider authorised to submit single touch for this client file you should tick the Agent box so you can submit the data on their behalf.

STP requires that you have internet access from your PayTek PC so check that Paytek can communicate with the gateway but clicking test connection.

You should ensure all your company information is entered into the Setup…Options screen and that you have all contact details for each employee.

Click the validate button and PayTek will send the employee details to the gateway for validation. Review any errors, correct them then re-validate your employee data.

NOTE: Do not forget to Accept the changes after entering the information

NOTE STP employs multiple validation layers. Some errors will be detected by PayTek, some by the gateway and some can only be detected by the ATO.

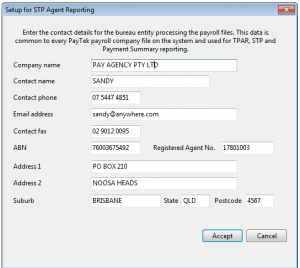

STP Agent details

If you have ticked the box to submit as a registered agent on behalf of clients enter your information into the STP Bureau Setup menu in Setup.

This will require a different declaration when submitting the STP pay events.

PayTek is now activated for STP.

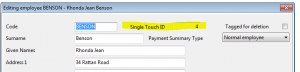

STP Employee Information

After activating STP you will see the STP ID for each employee in their data screen. This is unique for your ABN and will not change. This is important to ensure the data sent to the ATO is synchronised with your PayTek file.

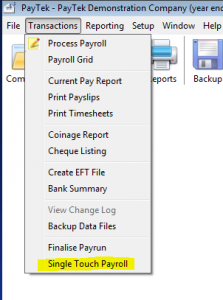

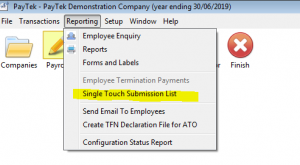

STP Menu Items

With STP activated several new menu items are available.

The main single touch screen is accessed from the transactions menu. It is the new final step in your payrun processing procedure. This option will immediately be active if you have a finalised payrun in your file. After finalising each payrun you will be prompted to submit your STP pay event.

The Single Touch Submission List will show details of each pay event submitted to the ATO and its status etc.

Submitting your STP Pay Event

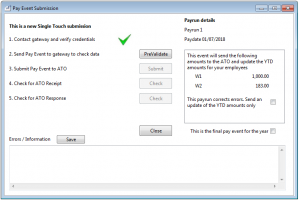

This is the main STP screen. It consists of a number of options and a 5 step process.

Step 1 – PayTek will automatically check that it can communicate with the gateway.

Check the payrun details. The W1 is the total wages to be reported and W2 is the tax withheld.

NOTE If the payrun is the last one for the year you should tick the box indicating it is the final event for the year. This flags your employee’s myGov accounts that their payment summary is complete and allows them to do their tax returns. This fulfils your payment summary obligation so you must send a final pay event by the deadline specified by the ATO

NOTE If your pay run has W1 or W2 amounts it should be reported as a pay event. When processing corrections etc it may be that you only report an update event that sends corrected employee information only. This will depend on the nature of the correction.

Step 2 – Click the button to send your pay event to the gateway for “pre-validation”. This checks for basic error such as missing addresses or invalid TFNs etc.

The gateway should respond quickly. Any errors will be listed in the error box. You should review and correct the errors. Save the errors to a file if you need to.

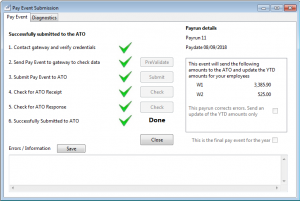

Step 3 – This step is submitting the pay event to the ATO. The gateway will do a second level validation of the pay event. Any errors will be listed in the error box. As with step 2 you should review and correct the errors. Save the errors to a file if you need to.

If no errors are reported in Step 3 the pay event will be sent to the ATO. Depending on the number of employees you have in your file the ATO should respond with a few minutes.

NOTE – This step is important as once the pay event is submitted to the ATO PayTek will limit your action until a response is received.

While the ATO is processing the pay event you cannot roll back or finalise a new payrun.

You can enter your next payrun but be aware if the ATO rejects the pay event you may have to unfinalise it to correct errors to resubmit it to the ATO.

Step 4 – This step is to check for a response from the ATO. This is a 2 stage response. The ATO strive to send a receipt within a couple of minutes. This is purely a response saying they have successfully received the pay event.

NOTE If the ATO sends the final response while you are waiting for the receipt PayTek will skip Step 5 and report the final response.

Step 5 – Having received the receipt step 5 is to check for the final response from the ATO. This will be a complete acceptance, partial acceptance or rejection of the entire pay event.

Normally we would expect the ATO to accept the pay event and you will see that message. If done you have finished your STP for the pay run.

If rejected you must review the error and resubmit your pay event. This may be due to

-

Data errors – in this case unfinalise the pay run, correct the errors, finalise and submit your pay event again.

-

Network or ATO system errors – in this case review the information from the ATO and resubmit.

A partial acceptance will mean that the pay event was accepted but some of your employees had errors. Depending on the error the ATO recommend that you can correct the errors which will then be updated in the next pay event.