This is a step-by-step example of paying an employee on termination in PayTek

We will use the PayTek demonstration data. Rhonda Benson is finishing work on 15-Sep-2016. The next pay period end is 16-Sep-2016. Rhonda’s normal pay is $1 140.00 paid for a standard 38 hour week. We have to pay her for the normal days worked as well as her unused annual leave. She has no other leave owing.

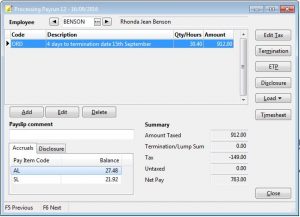

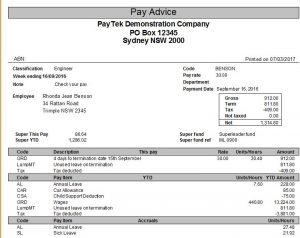

The first step is to pay Rhonda for the last weeks work. This means paying her for her last 4 days work. We enter the hours and PayTek calculates the tax. We put a note against the pay item to explain the unusual payment.

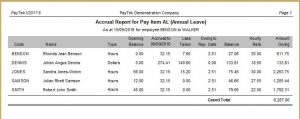

The next step is to work out how many hours annual leave is owed to Rhonda. Because Rhonda is a fulltime employee, we use the accrued leave report. The default report date is the last finalised payrun date. Override this by entering Rhondas termination date so the report will show the accrual as at this date.

Notice that the Owing to Rep. Date column shows the accrual from the last payrun date to the report date (ie from 09-Sep-2016 up to Rhonda’s termination date of 15-Sep-2016. So Rhonda is owed 27.06 hours equaling $811.80 of unused leave as at 15-Sep-2016. (Of course this does not include any leave loading so you should add it on if your company policy is to pay leave loading on termination.)

NOTE If the employee accrues leave as a percentage of hours worked or amount paid (ie a permanent part-time employee), we should use the payslip to review the accrual owed at the termination date as the amount owed will include the leave accrual for the current payrun.

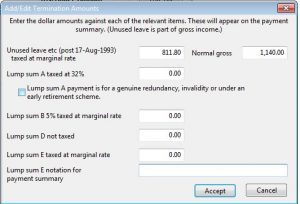

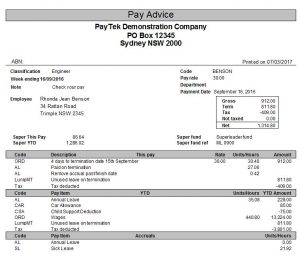

From the payroll screen click the termination button and enter the unused annual leave (dollar) amount in the box. Although this amount goes into the employees gross income on their payment summary, the ATO applies an averaging formula when calculating the tax on this amount. You must enter the employees “normal” wage so PayTek can calculate the tax.

If the employee is owed any other lump sum termination amounts, enter the dollar amount in the relevant box. These termination amounts may be relevant for leave (annual, long service etc) if accrued before 18-Aug-1993 or if the employee is leaving because of bona fide redundancy, invalidity or under an approved early retirement scheme.

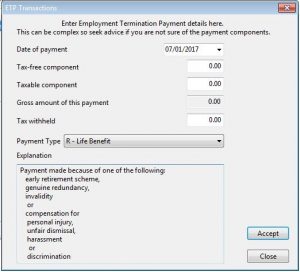

In certain cases you may have to pay your employee an Eligible Termination Payment. Such circumstances include death, permanent disability or redundancy of an employee. If you think this is the case you should consult your accountant who will assist you in calculating the amounts payable. You can then enter them into the ETP screen to pay the employee. PayTek will print a separate ETP payment summary at year end for these payments.

Having entered the termination payment into PayTek we have to review the payslip. If you show the annual leave accrual on the payslip you will notice that it shows the accrual up to the next pay period end date which is a day after Rhonda leaves.

PayTek cannot adjust the accrued leave hours because we are paying the unused leave as a termination amount.

We could delete the accruals from Rhonda’s masterfile so the hours no longer appear on the her payslip (simplest solution but you lose the accrual history so this is not recommended).

We could process the termination pay in a separate payrun ending on Rhonda’s termination date so the leave accrual would show the same hours as those paid in the termination amount.

Or we could enter the outstanding hours against the annual leave pay item to reduce the accrual to zero. To do this view the payslip and not the balance of accrued annual leave (in hours). Then enter a record for annual leave with the accrued balance of hours BUT NO DOLLAR AMOUNT. Note in the comment that this is canceling the accrual which has been paid as a termination amount.

Below is an example of the payslip with the annual leave adjustments to reduce the accrual to zero. Because Rhonda is leaving before the end of the pay period we have to adjust for the period (in this case one day) that she is not entitled to as at the 09-Sep-2005.

Disclaimer: This information is of a generic nature intended to assist in the use of the software. For specific advice regarding your particular circumstances please seek assistance from your Accountant, the Australian Taxation Office or your IT Consultant as appropriate.