How do I get PayTek to correctly calculate the SGL for an employee?

This is done by ensuring the employee belongs to a super fund and that the pay item group that fund uses to calculate the SGL contains the correct pay items.

Step 1 – Assign the super fund to the employee.

Our employee is a member of the superleader fund. You can change funds part way thru the financial year if necessary.

Step 2 Check the pay item group used by the super fund to calculate the SGL

As you can see this Super fund used the pay item group called Superannuation Calc to do the calculation.

Step 3 Ensure that the superannuation pay item group is setup correctly.

The pay items included in this group determine how the SGL is calculated for any fund using this pay item group. This allows you flexibility in calculating the SGL.

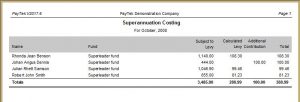

Step 4 Check the superannuation report after finalising the payrun.

The report shows that the SGL is calculated on the employees gross wages (pay item ORD). A salary sacrifice appears as an additional contribution on the report (and is noted as a salary sacrifice on the SGL remittance).

Disclaimer: This information is of a generic nature intended to assist in the use of the software. For specific advice regarding your particular circumstances please seek assistance from your Accountant, the Australian Taxation Office or your IT Consultant as appropriate.