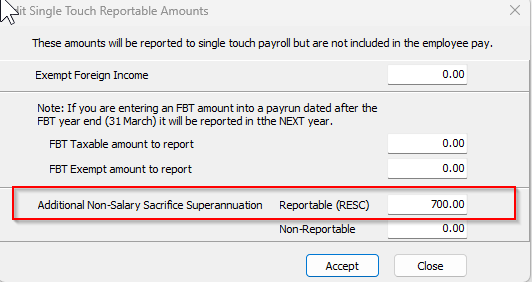

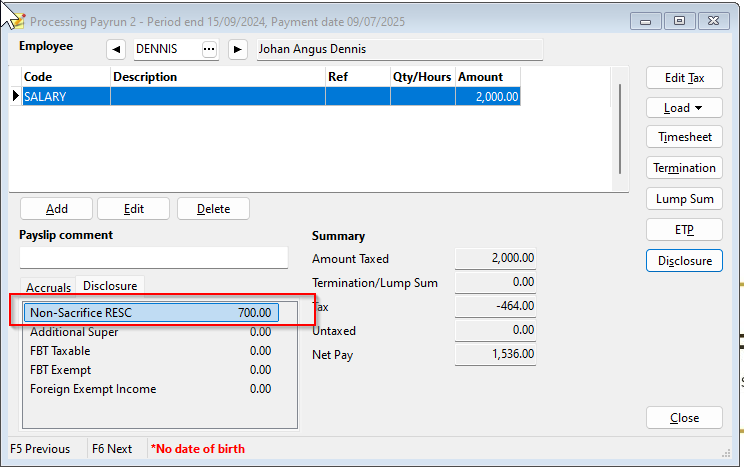

If you need to report RESC superannuation for extra super paid to a director you can report it in Paytek via the Disclosure button when entering the pays.

This example shows you how to do this.

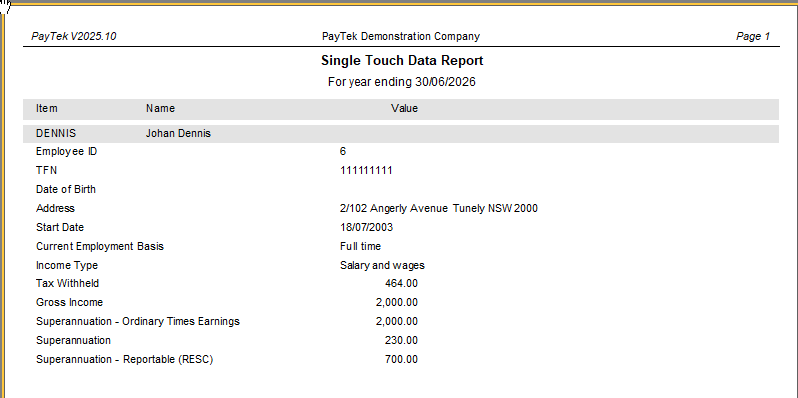

This will show on the employee payslip and the superannuation reports so it can be paid with other superannuation.

This superannuation does not affect the salary reported.

This superannuation will be reported via Single Touch Payroll and should be paid to the superannuation fund along with the superannuation guarantee amount.

Disclaimer: This information is of a generic nature intended to assist in the use of the software. For specific advice regarding your particular circumstances please seek assistance from your Accountant, the Australian Taxation Office or your IT Consultant as appropriate.