To deduct child support, we set up a pay item to keep track of the deductions made.

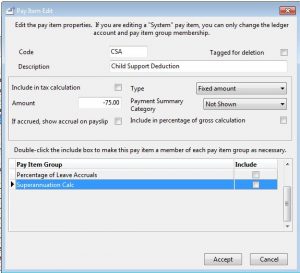

Create a new pay item as you normally would and assign it an appropriate code and name. Make it a fixed amount type. (If you are only using it for one employee you can enter the deduction amount as well as a negative because we are deducting it from the person’s pay.) Because it comes out of their after-tax pay it is NOT taxed when paid and it will not be shown on the payment summary (Category). Nothing else should be ticked.

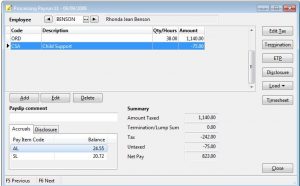

Now it is simply adding this pay item to the employees pay each period. Remember a deduction must show as a negative amount and you can see that it is untaxed meaning the deduction comes out of the pay after tax.

It is a good idea to add this deduction to the employee’s standard pay so you do not forget to deduct it.

At the end of each month or quarter (depending on when you remit the deducted child support to the appropriate agency), you can print a detailed pay item report showing the amount deducted for the specified period. You can check this amount by referring to the enquiry screen pay items tab that will show each transaction for each employee.