Jobkeeper Extension and PayTek

The Jobkeeper program is a government initiative designed to subsidise wages paid to employees.

It has been extended for a further 13 fortnights through to the end of March 2021.

Click here for details ATO Jobkeeper

The fortnights are specified in the table below:

| FN | FN Period | Start Allowance Name | Finish Allowance Name | Tier 1 Min | Tier 2 Min |

|---|---|---|---|---|---|

| 14 | 28/09/2020 – 11/10/2020 | JOBKEEPER-START-FN14 | JOBKEEPER-FINISH-FN14 | $1 200 | $750 |

| 15 | 12/10/2020 – 25/10/2020 | JOBKEEPER-START-FN15 | JOBKEEPER-FINISH-FN15 | $1 200 | $750 |

| 16 | 26/10/2020 – 08/11/2020 | JOBKEEPER-START-FN16 | JOBKEEPER-FINISH-FN16 | $1 200 | $750 |

| 17 | 09/11/2020 – 22/11/2020 | JOBKEEPER-START-FN17 | JOBKEEPER-FINISH-FN17 | $1 200 | $750 |

| 18 | 23/11/2020 – 06/12/2020 | JOBKEEPER-START-FN18 | JOBKEEPER-FINISH-FN18 | $1 200 | $750 |

| 19 | 07/12/2020 – 20/12/2020 | JOBKEEPER-START-FN19 | JOBKEEPER-FINISH-FN19 | $1 200 | $750 |

| 20 | 21/12/2020 – 03/01/2021 | JOBKEEPER-START-FN20 | JOBKEEPER-FINISH-FN20 | $1 200 | $750 |

| 21 | 04/01/2021 – 17/01/2021 | JOBKEEPER-START-FN21 | JOBKEEPER-FINISH-FN21 | $1 000 | $650 |

| 22 | 18/01/2021 – 31/01/2021 | JOBKEEPER-START-FN22 | JOBKEEPER-FINISH-FN22 | $1 000 | $650 |

| 23 | 01/02/2021 – 14/02/2021 | JOBKEEPER-START-FN23 | JOBKEEPER-FINISH-FN23 | $1 000 | $650 |

| 24 | 15/02/2021 – 28/02/2021 | JOBKEEPER-START-FN24 | JOBKEEPER-FINISH-FN24 | $1 000 | $650 |

| 25 | 01/03/2021 – 14/03/2021 | JOBKEEPER-START-FN25 | JOBKEEPER-FINISH-FN25 | $1 000 | $650 |

| 26 | 15/03/2021 – 28/03/2021 | JOBKEEPER-START-FN26 | JOBKEEPER-FINISH-FN26 | $1 000 | $650 |

The extension is a continuation of the original scheme with some refinements.

- For any employees already on Jobkeeper you do NOT have to enter a new start code.

- You must determine if each eligible employee is a Tier 1 or a Tier 2 employee and send the appropriate code in their next pay.

Jobkeeper Extension requirements - Jobkeeper Extension 1 covers fortnights 14 to 20. To be eligible you, the employer must satisfy the “fall in revenue” test for this period. You must then satisfy the minimum payment rule for your employees ($1 200 per fortnight for Tier 1 and $750 for Tier 2) making a topup payment if necessary.

- Jobkeeper Extension 2 covers fortnights 21 to 26. To be eligible you, the employer must satisfy the “fall in revenue” test for this period. You must then satisfy the minimum payment rule for your employees ($1 000 per fortnight for Tier 1 and $650 for Tier 2) making a topup payment if necessary.

1. Employee reporting

Because this is a continuation of the program you do not have to send a new start code for any employees already on Jobkeeper. Also you do not have to complete the agreement for for employees already on Jobkeeper.

To start or restart an employee you must send the fortnight start allowance code as before (eg JOBKEEPER-START-FN14 if you are claiming from fortnight 14).

If an employee is terminated or otherwise becomes ineligible for you to claim the subsidy you must send the fortnight finish allowance code for the fortnight they become ineligible. (eg if your last claim for an employee is fortnight 18 you would add JOBKEEPER-FINISH-FN19 to the employees pay thus reporting that they are finished from fortnight 19 onwards.)

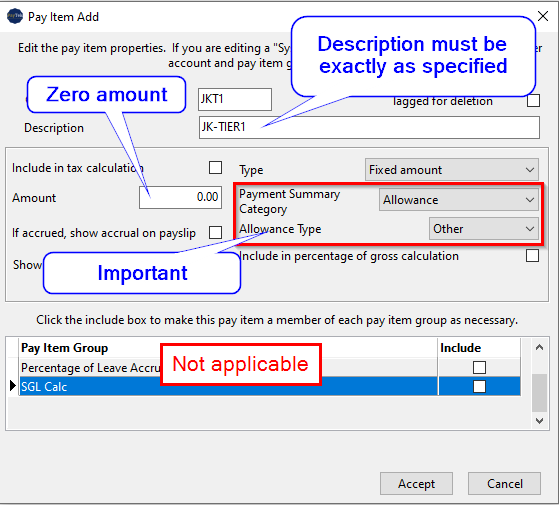

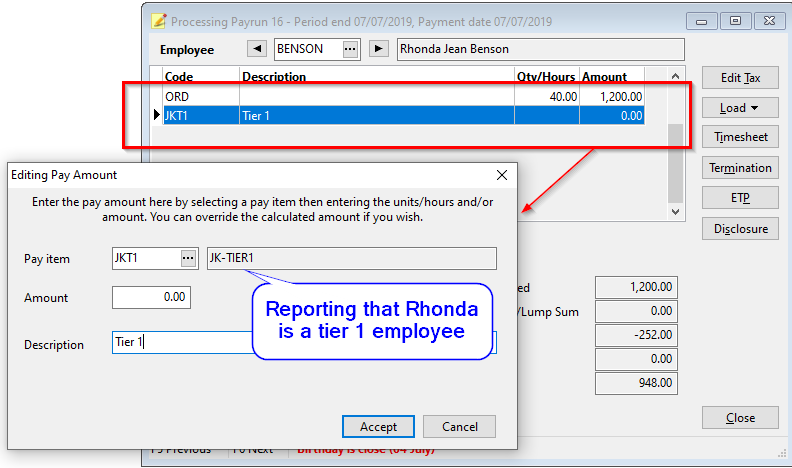

2. Advising the ATO what tier your employees are.

Determine what tier each employee qualifies for. Note that you make this assessment once only and it applies to the employee for the entire Jobkeeper extension period. So the employees tier will not change and you would only use the correction codes if you sent the wrong code.

Note you must send the tier code for each employee before you make your first claim in October (You can send it before October)

Jobkeeper employee tier qualification

| Usage | Allowance Description |

|---|---|

| Advises that employee is tier 1 | JK-TIER1 |

| Advises that employee is tier 2 | JK-TIER2 |

| If you reported an employee as tier 1 in error this offsets the original notification. You should also send the JK-TIER2 code. | JK-TIER1X |

| If you reported an employee as tier 2 in error this offsets the original notification. You should also send the JK-TIER1 code. | JK-TIER2X |

Now add it to their pay. You only have to send the “tier” allowance entry once. Make sure the amount is left as zero.

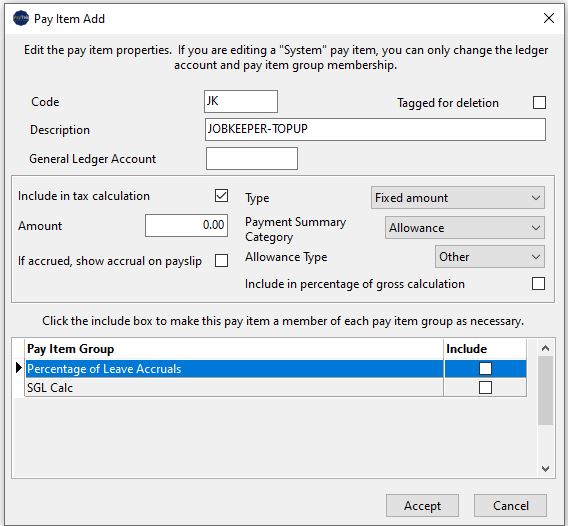

3. For Jobkeeper extension 1 you must pay your employees at least $1 200 or $750 per fortnight respectively to claim the subsidy. The jobkeeper topup code should be used if necessary.

The name MUST be exactly as specified ie JOBKEEPER‑TOPUP (All capitals, no spaces and include the hyphen). Note you do not have to pay superannuation on this top-up payment but may do so. This payment is taxed.

4. For jobkeeper extension 2 the only change is that the subsidy and minimum payments are reduced to $1 000 and $650 respectively for tier 1 and tier 2 employees.

NOTES

If you ( the employer) are not claiming Jobkeeper for the extension period you do not have to send finish codes for fortnight 14 after claiming for fortnight 13.

Also be aware that an employer can qualify for the second quarter (extension 2) even though they failed the eligibility test for the first quarter (extension 1)