JobKeeper and PayTek

The JobKeeper program is a government initiative designed to subsidise wages paid to employees.

It provides a subsidy to eligible employers of $1 500 per fortnight per eligible employee for up to 13 specific fortnights.

The fortnights are specified in the table below:

| FN | FN Period | Start Allowance Name | Finish Allowance Name |

|---|---|---|---|

| 01 | 30/03/2020-12/04/2020 | JOBKEEPER-START-FN01 | JOBKEEPER-FINISH-FN01 |

| 02 | 13/04/2020-26/04/2020 | JOBKEEPER-START-FN02 | JOBKEEPER-FINISH-FN02 |

| 03 | 27/04/2020-10/05/2020 | JOBKEEPER-START-FN03 | JOBKEEPER-FINISH-FN03 |

| 04 | 11/05/2020-24/05/2020 | JOBKEEPER-START-FN04 | JOBKEEPER-FINISH-FN04 |

| 05 | 25/05/2020-07/06/2020 | JOBKEEPER-START-FN05 | JOBKEEPER-FINISH-FN05 |

| 06 | 08/06/2020-21/06/2020 | JOBKEEPER-START-FN06 | JOBKEEPER-FINISH-FN06 |

| 07 | 22/06/2020-05/07/2020 | JOBKEEPER-START-FN07 | JOBKEEPER-FINISH-FN07 |

| 08 | 06/07/2020-19/07/2020 | JOBKEEPER-START-FN08 | JOBKEEPER-FINISH-FN08 |

| 09 | 20/07/2020-02/08/2020 | JOBKEEPER-START-FN09 | JOBKEEPER-FINISH-FN09 |

| 10 | 03/08/2020-16/08/2020 | JOBKEEPER-START-FN10 | JOBKEEPER-FINISH-FN10 |

| 11 | 17/08/2020-30/08/2020 | JOBKEEPER-START-FN11 | JOBKEEPER-FINISH-FN11 |

| 12 | 31/08/2020-13/09/2020 | JOBKEEPER-START-FN12 | JOBKEEPER-FINISH-FN12 |

| 13 | 14/09/2020-27/09/2020 | JOBKEEPER-START-FN13 | JOBKEEPER-FINISH-FN13 |

The program is based around 3 steps.

- Enrol in the Jobkeeper program

- Report the payments to eligible employees thru Paytek via single touch reporting

- Make a declaration at the end of each month to release the payments to you.

Step 1. Enrolment

Work out if you (the employer) are eligible to enrol in the Jobkeeper program. Also work out if you have any eligible employees.

All the information you need is on the ATO website at http://www.ato.gov.au/jobkeeper

If the answer is YES you must enrol in the program on the ATO business portal (The ATO will advise when this is available and how to enrol – currently scheduled for April 20).

As part of the enrolment process you must complete this form with each eligible employee to signify their agreement to being part of the scheme.

https://www.ato.gov.au/Forms/JobKeeper-payment—employee-nomination-notice/

Step 2. Processing in Paytek.

To notify the ATO that you are claiming Jobkeeper for an employee you must tell them the first fortnight you are claiming for.

You do this by creating a “start” allowance pay item in Paytek and adding it to the employees pay during the relevant fortnight. (The “start” allowance names are listed in the schedule above)

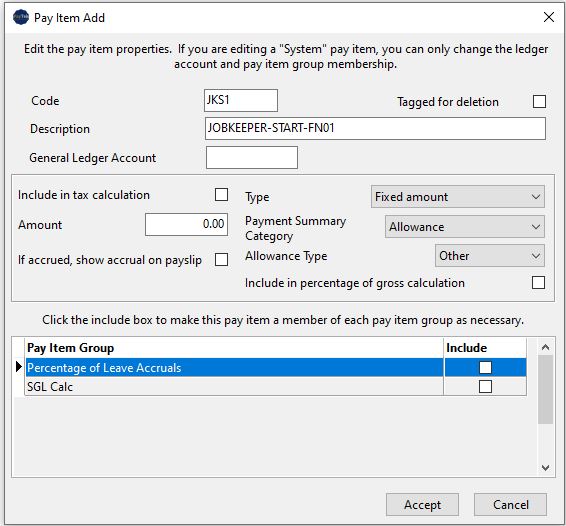

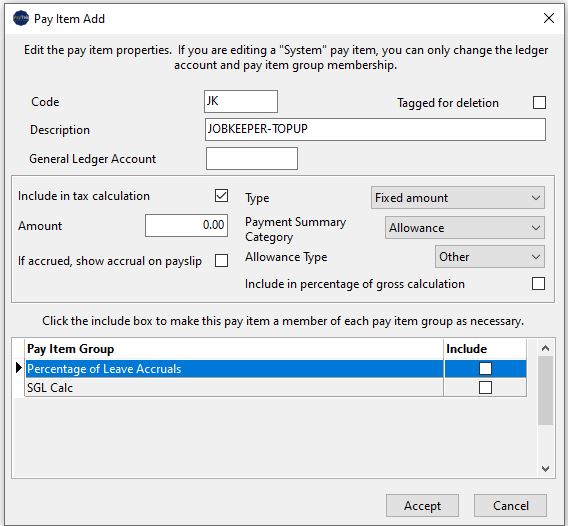

Create the allowance in Paytek. (The name must be exactly the same as specified by the ATO (ie all capitals, no spaces and include the hyphen and leading zero in the fortnight number).

For example if you are going to claim Jobkeeper for an employee from the second fortnight you create the allowance named JOBKEEPER‑START‑FN02 (the code for the allowance in Paytek is not critical) and add it to the employees pay during that fortnight.

You only have to enter a “start” allowance once for each employee (not for every fortnight).

You have to enter the correct fortnight “start” allowance for every eligible employee even if you do not have to pay a top-up payment for them.

This is how to create the start allowance for the first fortnight in Paytek. (If you claim Jobkeeper for an employee starting in fortnight 4 you need to create and use the JOBKEEPER‑START‑FN04 and so on)

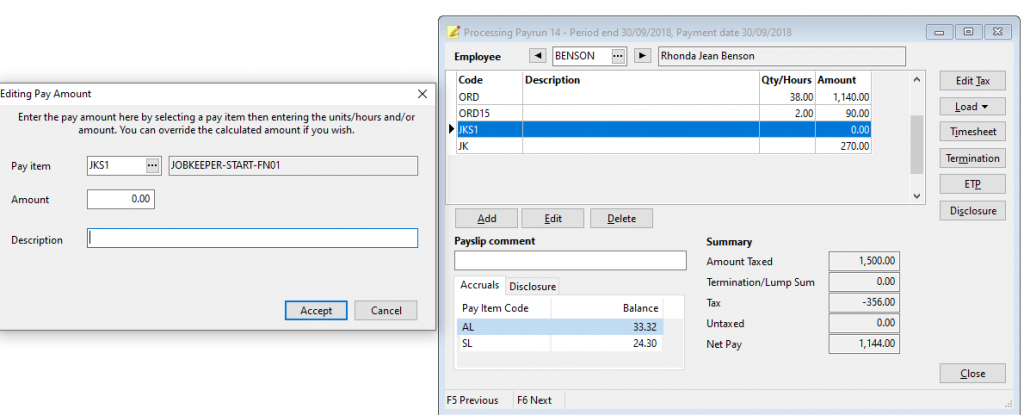

Now add it to their pay. You only have to send one “start” allowance entry. Make sure the amount is left as zero.

To qualify for a Jobkeeper payment for an eligible employee you must pay them at least $1 500 for the fortnight you claim for (per the schedule above).

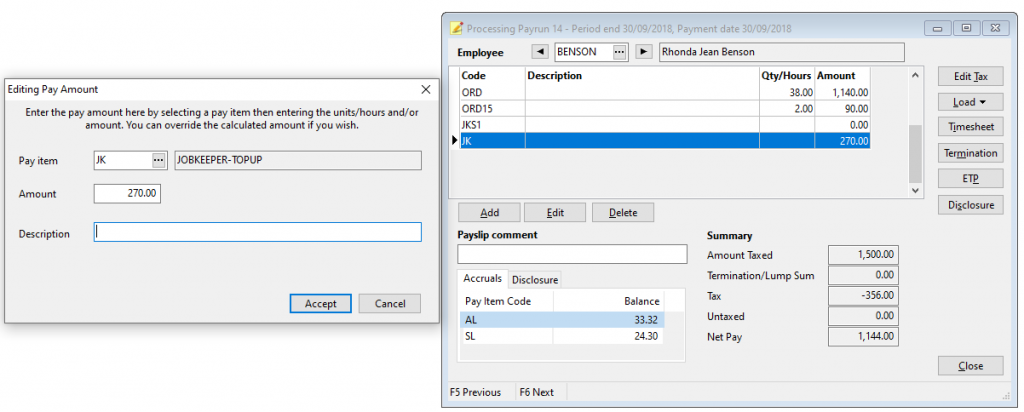

In this example a top-up payment is required to reach $1 500 in the fortnight as the normal pay was only $1 230.

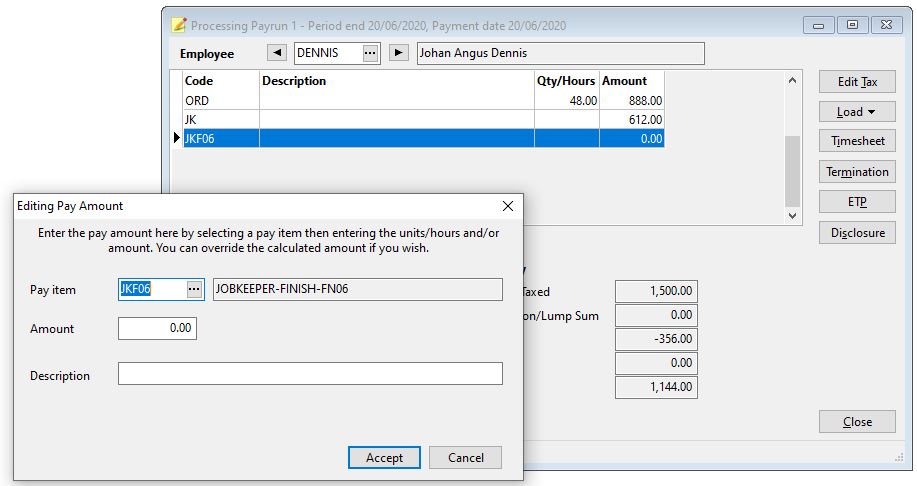

If you stop claiming Jobkeeper for an employee (they resign or are terminated or cease to be eligible) you have to notify the ATO by entering a ‘finish’ allowance. You do this by adding the “finish” allowance for the last fortnight you are claiming which is then sent with single touch.

This example shows how to notify the ATO that your last claim for Jobkeeper for this employee is for fortnight 6 (ie during the fortnight 08/06/2020 to 21/06/2020)

UPDATE 24-Apr-2020: The ATO have changed how you report the jobkeeper finish fortnight for an employee. If the last eligible fortnight is 6 then in your last payrun in jobkeeper fortnight 6 you enter the “finish” allowance for fortnight 7 ie JOBKEEPER-FINISH-FN07 to indicate that the eligibility finished from fortnight 7 onwards.

Step 3. Making the monthly declaration.

The ATO have advised that you will be required to make a declaration at the end of each month to trigger the payments to be made to you. This will be via the ATO business portal and the ATO will notify you of the process when they have established it in May.

NOTES

If you are claiming Jobkeeper for an employee from fortnight 1 you can enter the start allowance for fortnight 1 ie JOBKEEPER‑START‑FN01 in their next pay ( This will notify the ATO to backdate it as fortnight 1 is finished). The ATO will allow a claim for the first two April fortnights as long as you have paid your employee $1 500 per fortnight for April by 8-May-2020.

You can start processing your Jobkeeper payments in Paytek immediately as the ATO is still working on the enrolment process.

If you pay weekly you can process your pays as normal just making sure the eligible employees are paid at least $1 500 in the fortnightly period you are claiming for. (If you are paying a top-up you can spread it over each week of the fortnight).

The payment date of the Paytek payrun is the relevant date when aligning your payruns to the Jobkeeper fortnight schedule shown above.

The Jobkeeper program spreads over the end of financial year. You do NOT have to enter another “start” allowance for your employees in the next financial year as the original “start” allowance sent still applies.

The Jobkeeper program terminates after fortnight 13 automatically so you do not enter the “finish” allowance for fortnight 13. (Entering the finish allowance for fortnight 13 will indicate that the employee is not eligible for a payment for fortnight 13.)

You only have to create each “start” and “finish” Jobkeeper allowance pay item once in Paytek. Then use them for each employee as required.