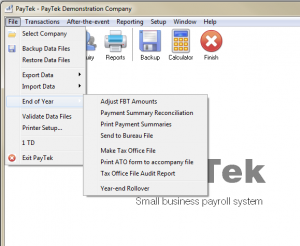

From the File Menu, select End of Year.

Adjust FBT Amounts

Because reportable FBT amounts must be within the FBT financial year ending in March, this option allows you to adjust the FBT amount to be declared on the employees Payment Summary by adding an entry in the FBT year regardless of the current payrun date. Check the totals by printing the FBT Report on the Reports menu.

To amend the other reportable amounts (other payments, CDEP amounts and Foreign tax paid) process an adjusting payrun dated 30th June.

Payment Summary Reconciliation

This report assists in reconciling the payments made to each person and how they appear on each Payment Summary. It lists and counts all the payment summaries and totals the monthly amounts of tax withheld.

Print Payment Summaries

This option allows you to print Payment Summaries for the employees. It will print the correct summary for the different types of employee and for any ETP amounts paid.

If you need a file copy of the summaries print multiple copies.

Make Tax Office Transfer Disk

Because PayTek prints the payment summaries on blank paper, you are required to submit the data to the Tax Office electronically by uploading to the business portal. Selection of this menu option will create the necessary data file.

Year-End Rollover

This procedure closes the current financial year, and rolls the payroll into the new year. You are able to prepare one pay run for the new year before rolling the old year forward, but that pay run cannot be finalised until the roll-over has been completed.

During this process, all PayTek transaction files are erased, except for any transactions in the current pay run. It is strongly advised that you keep the prior year files online for future reference.

You can nominate a code to hold the prior years files in. This code will contain the files for the current year and appear on the companies list.