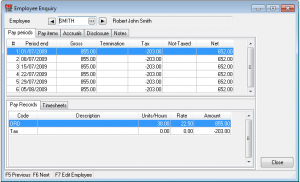

The employee enquiry provides details for an employee on screen. The five tabs show the following

Pay periods

This shows the employees pay history in the current financial year on a payrun by payrun basis. The top grid shows each payrun and the grids below show the detailed payrun and timesheet transactions for the highlighted payrun.

To print these details use the Pay Period Reporting option.

Pay items

This shows the employees pay history in the current financial year per pay item. You can see the total paid to each pay item in the top grid with the detailed transactions for each pay item in the grid below.

To print these details use the Detailed Employee Reporting option.

Accruals

This shows the employees accrual history for each pay item they accrue in the current financial year. The top grid shows the pay item, current accrual amount per period and the opening balance. The details grid below shows the accrued amounts for each payrun and any amounts taken by the employee with the balance owed.

Disclosure

This shows the employees disclosure amounts on file for the current financial year. The grid shows the entries for each payrun. (Any FBT adjustment amounts will appear without a payrun number and be dated 31st March.) The summary appears at the foot of the grid.

Notes

The notes tab shows the free form notes that you can enter against each employee. You can edit these notes at any time on the enquiry screen or reference this screen when processing a payrun. Save the changes by clicking the “Accept” button.

To print these details use the Masterfile Listing.

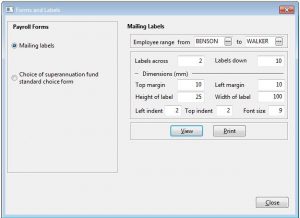

Forms

PayTek provides you with a number of forms that can be printed anytime.

Choice of superannuation fund

This form should be printed out for each new employee to give them the option to choose their own superannuation fund. If you have already created the employee and attached them to the default company fund the report will be pre-filled with the employer data.

Mailing labels

You can specify labels to print and the range of employees to print them for.

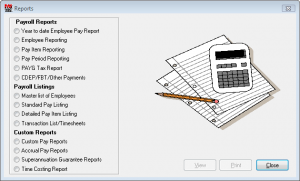

Payroll Reports

Year-to-Date Employee Pay Report

This report lists the summary pay run information for every employee, for a nominated range of pay run dates.

The default starting date is the first pay date for the year.

If you have entered departments you can elect to subtotal by department on this report.

Employee Reporting

This option allows you to print a report, covering any period in the financial year, showing the year-to-date amounts paid to employees.

Enter any dates in the current year, and any range of employees, then nominate Detailed or Summary. If detailed is selected, the report gives a breakdown of each employee’s net pay into the different Pay Items for the selected period. The summary report simply presents each employee’s net pay for the period.

Pay Item Reporting

This provides reporting on a range of Pay Items covering any period in the current financial year.

Enter any dates in the current year, and any range of Pay Item codes, then nominate Detailed or Summary. The detailed report lists all pay runs for each employee, for each pay item selected. The summary report presents the total paid under each pay item for the period.

Pay Period Reporting

This report is a list of pays between a nominated starting date and ending date, showing the total value of each pay run in the period.

PAYG Tax Report

This report lists the PAYG tax amounts for each employee, for any range of pay runs. It will be useful for working out your PAYG liability for each month or quarter, and for reconciling the deductions made at the end of the year. The gross amounts include all payments that should be declared on your Business Activity Statement.

You can request a summary or detailed report.

CDEP/FBT/Other Payments Summary

This report lists all the miscellaneous reportable payments made to employees in a specified period. Payments to normal employees will appear in the CDEP, Reportable FBT or Other Amounts reports. Payments to other employees will all appear in the Other Payments report.

Note that FBT amounts recorded are shown on the payment summary in accordance with the FBT year, which runs April to March.

Payroll listings

Master List of Employees

This report lists the personal details for each employee currently on file.

The From Code and To Code inputs default to the first and last codes on file. The program will accept non-existent codes, as it will search through the file sequentially for any codes falling within the specified range.

Standard Pay Listing

This report lists the standard pays on file for a nominated range of employees. Remember that the PAYG tax is not part of a standard pay, but is calculated each pay period, according to the tax information on file for that employee at that time.

Detailed Pay Item Listing

This report provides a listing of the pay items on file, including those established and used by the system for tax and lump sum termination payments.

Transaction Listing

This report will print the full payroll details for a specified range of pay runs, including pay item comments. This report is useful as an audit trail of all payroll transactions for each payrun.

Custom reports

Custom Pay Reporting

Any custom reports that you have established can be printed here. You could use them to calculate payroll tax or workers compensation insurance liability on a monthly or annual basis etc or use the reports to filter and accumulate data for groups of pay items. You can include the superannuation guarantee amount in the custom report calculation if it is relevant.

Accrued Pay Reports

These reports display each employee’s leave entitlements based on the pay items that have been set up to accrue certain pay items such as annual leave and sick leave. It gives an analysis of the hours accrued and taken, and calculates the amount owing up to the pay run date specified based on the pay rate on file. If you pay an employee a flat amount per period, enter a notional hourly rate for reporting purposes.

Select the pay item to report on and the date to show accrual transactions up to. Every employee that accrues that specified pay item will appear on the report.

Superannuation Guarantee Reports

These reports provide a

- Month by month summary of the superannuation levy for each superannuation fund.

- Costing report giving the superannuation details for each selected fund. It will also subtotal by department if required.

- Monthly remittance advice for each superannuation fund (including any employee contributions to the fund)

- Quarterly report for each employee showing the amount paid to the superannuation fund on their behalf each quarter

NOTE: You can select one or a number of funds to print the reports for. Separate schedules will print for each fund except for the costing report. To select multiple funds, hold the Control key down and click the fund name.

Timesheet costing report

If you have the costing feature activated you can print a date based report comparing the amount paid with the amount charged for your employees.

TFN Declaration file for ATO

This option will create a file of TFN declaration data for every employee who commenced employment between the nominated dates. You can then remit this file to the ATO electronically (ie on a disk) or via their ECI client system. The latter system will validate the contents of the file before sending it via the internet. If using this feature be sure to enter all the information for the employee on the Contact details and TFN Decl’n tabs.

Configuration status report

This report is accessed from the reports menu and provides information about your PayTek installation such as file sizes and locations and various system wide settings. It will be useful for support staff if you have problems.