The PayTek TPAR feature provides a simple way to fulfil your taxable payments annual reporting obligation.

This allows you to create a masterfile of subcontractors with all their required details. You can then enter details of payments made to the during the year.

Once complete, PayTek will create a file of the transactions (TPAR) that you can lodge with the ATO via your business portal.

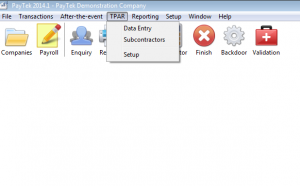

After you activate TPAR you will see a new menu on the PayTek main screen.

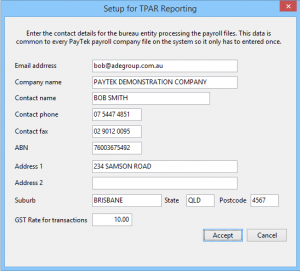

Setup supplier information

These contact details are shared by the after-the-event and TPAR feature. These ensure that you are the supplier of the information to the ATO regardless of the client file you are using.

Enter these details as they are compulsory fields in the TPAR file.

The GST rate is a default used in data entry.

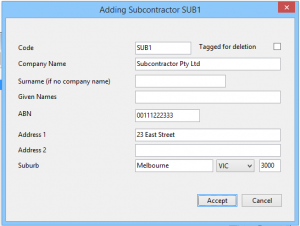

TPAR Subcontractors

Enter the subcontractor details.

The code is for your reference and is not included in the TPAR file.

You must enter either a company name or personal name for each subcontractor.

You can tag a contractor for deletion any time. This has no effect until you perform an end of year rollover of the company file where tagged subcontractors are deleted from the new year.

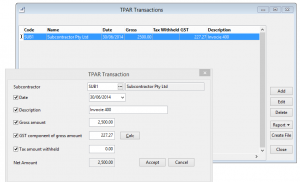

TPAR Data Entry

The data entry screen is where you can enter each transaction (or totals only) for each subcontractor. All the transactions are included in the TPAR file.

The checkboxes on the data entry screen allow you to skip fields when entering the information.

The Calc button will calculate the GST component of a gross amount using the rate entered in the setup screen. This can be overridden if necessary.

The description is not included in the TPAR file but can be used for invoice numbers etc.

TPAR Reporting

Once all the reportable transactions are entered you can print a detailed or summary report of them for checking etc.

TPAR File

The next step is to create the TPAR file containing all the reportable transactions. This is a text file in the specified ATO format.

It is recommended that you create the file on your desktop. You can then submit it via the ATO business portal. This process validates the contents then lodges the information.

If the file is rejected with errors the ATO provides an error report. This may detail missing contact details etc for subcontractors. You should make the corrections in PayTek then create a new file and lodge it again.

When you have successfully lodged the file, rename it and archive it