Each leave accrual is set up separately for each employee. You can share the same pay item for annual leave and specify a different accrual method for each employee. This means your annual leave pay item can accrue manually for one employee and pro-rata for another.

It is recommended that you accrue long service leave from the point where the employee is entitled to a pro-rata payout on termination (normally after some years service).

When setting up a leave accrual you need to calculate the opening balance as a starting point. This will be the entitlement as at the end of the previous payrun (if any). Once created, Paytek will accrue leave every time you finalise a payrun.

Note that if you process an extra payrun (out of cycle) you must specify it as such so Paytek does not add leave accruals for the extra payrun.

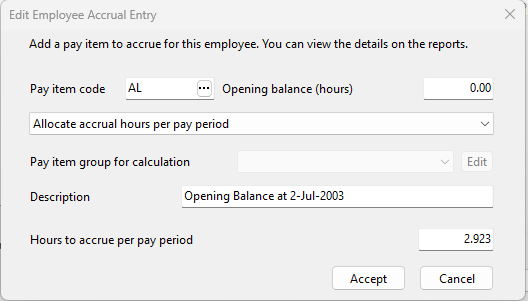

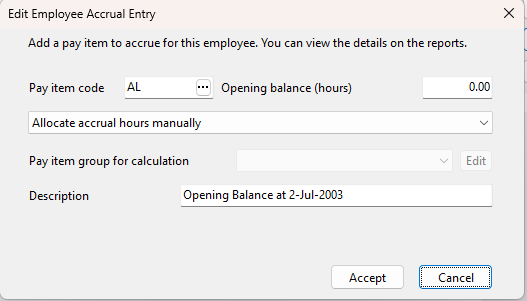

Method 1. The simplest method is to allocate fixed hours for each payrun. This is suitable for salaried staff or full time staff with fixed hours. Typically a full time employee would accrue 4 weeks x 38 hours per week divided by 52 weeks per year = 2.923 hours per week.

This method accrues the same number of hours regardless of the hours worked.

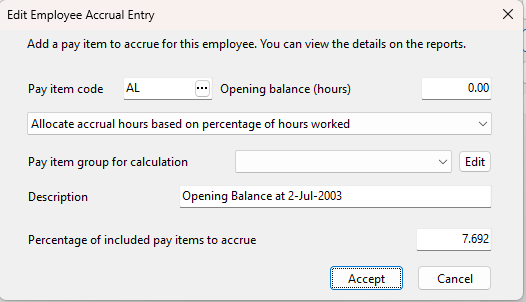

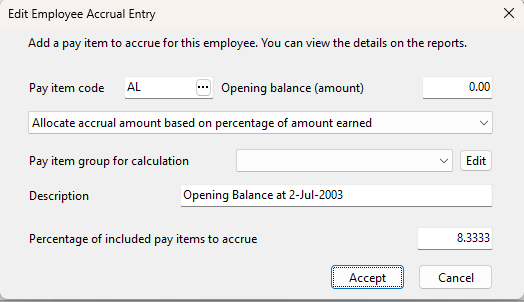

Method 2. Permanent part-time employees who work varying hours accrue pro-rata leave based on the hours worked each payrun (typically for ordinary hours not including overtime). Allowing for sick and annual leave actually taken during the year you would accrue their leave at 4 weeks out of 52 weeks = 7.692%. Note that the employee also accrues leave while on leave. So a full time employee using this method would still accrue 4 weeks leave each year. In year one they would work 52 weeks then be entitled to 4 weeks leave. In year 2 they work 48 weeks but take 4 weeks leave accruing a further 4 weeks on the (48 hours worked + 4 weeks leave).

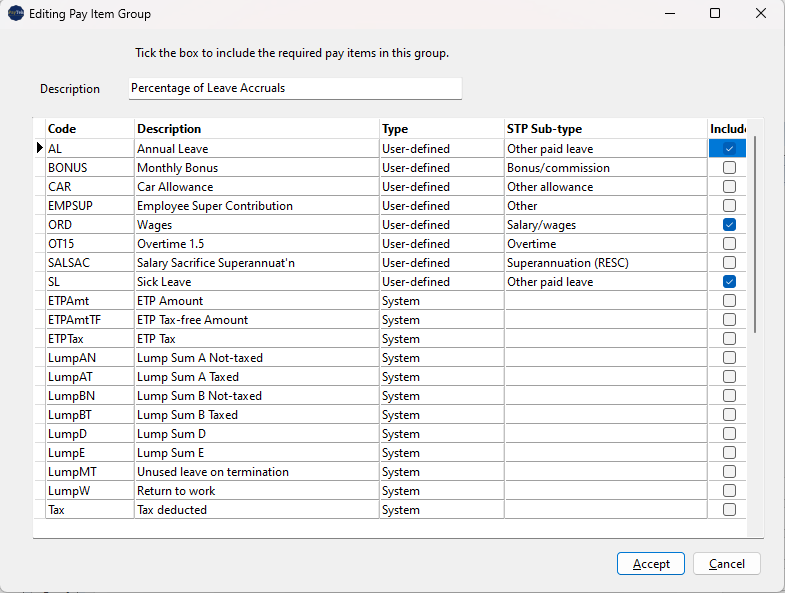

Using this method requires a pay item group that tells Paytek what pay items to include in the calculation.

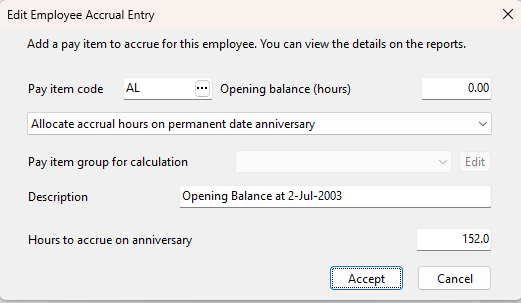

Method 3. This method allocates a full years entitlement on the employees anniversary date. This may apply to an award that provides 10 days leave each year but they employee may not be paid if they have not accrued the entitlement. This may be useful for accruing Long Service Leave if the employee has to work a full year before being eligible to take the leave. (Note it may require some manual adjustments when paying out the leave on termination)

Method 4. Accruing leave manually is useful for tracking RDO’s. You can allocate the hours owed each week and pay it when the employee takes an RDO. This ensure the balance at year end is rolled forward as the opening balance owed in the next financial year

Method 5. Some awards may accrue leave on the basis of the amount earnt for casual workers. This may be 1/12 of the amount earnt = 8.333%

When using a pro-rata method (ie percentage accrue based on the hours worked you need to use a pay item group. The example below shows the pay items included in the calculation.

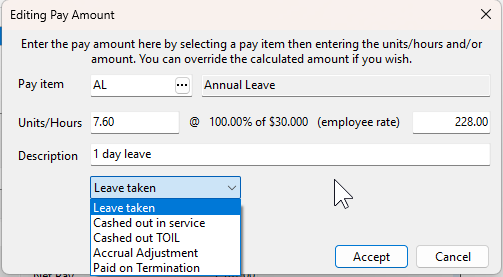

Leave pay item types offer different categories when paying it to your employee. This is required by Single Touch Reporting. Regardless of the category the hours paid will adjust the balance of the accrual entitlement.

Leave taken. This is normal leave taken. Superannuation is paid and pro-rata leave is accrued on these hours.

Cashed out in service. Superannuation is paid on leave cashed out but pro-rata leave is not accrued on the hours cashed out.

Cashed out TOIL. Similarly superannuation is paid on the cashed out TOIL but pro-rata leave is not accrued on the hours cashed out. This is reported as overtime to STP.

Accrual adjustment. This allows you to correct a leave balance (+ hours to increase the employees entitlement and -hours to reduce it) This may be useful if a salaried employee is terminated part way thru a week and you want to adjust the entitlement for the days not worked in the week. (Paytek automatically accrues a full weeks entitlement on method 1 for each payrun)

Paid on termination. This allows you to paid the accrued balance to the employee on termination. No superannuation is paid on these hours. If you pay leave loading you should also pay the equivalent leave loading hours on termination.