FAQ End of Year Processing

With the introduction of Single Touch Payroll the end of year processing for payroll is completely paperless.

To fulfill your reporting obligations you simply send your last pay event to single touch with the “final” flag set by the due date stipulated by the ATO.

Note the ATO require your final notification to be sent by 14th July to avoid late lodgement penalties.

To arrive at this point we recommend the following process in Paytek.

1. Process and finalise your last payrun for the financial year but do not send it to single touch immediately. (The payrun payment date is the key date that determines which financial year a payrun falls into).

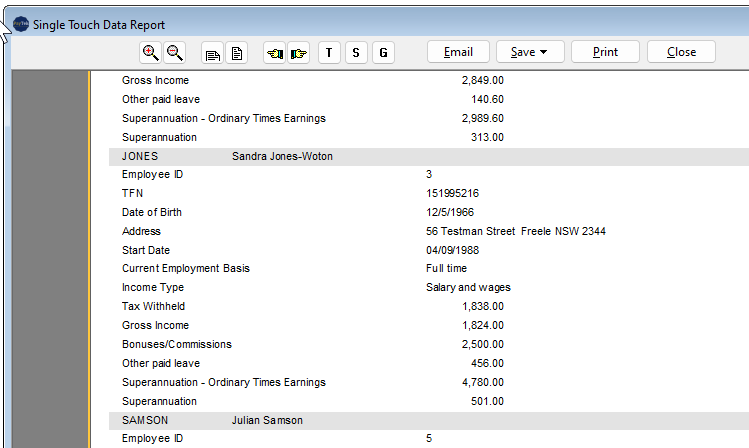

2. Check the year-to-date totals for each employee using the reports. The summary and detailed single touch reports on the end-of-year menu will show you the single touch totals reported after you have sent your last pay event.

3. If you report fringe benefits, check the totals to be reported by viewing the FBT report for the FBT year which ends on March 31. (The reportable amounts are also shown in the Single Touch Data Report)

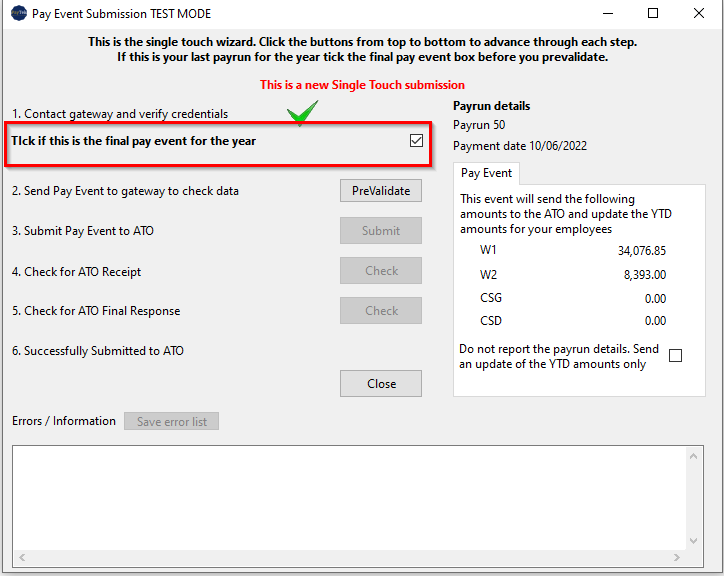

4. When you are confident the figures are correct you can send the final payrun as your last event for the year. Tick the “Final pay event for the year” box. The final flag updates the MyGov files for each employee to “Tax Ready” so they can lodge their tax returns.

5. When you send the final event you have completed the payroll for the year. Check the single touch submission list as below.

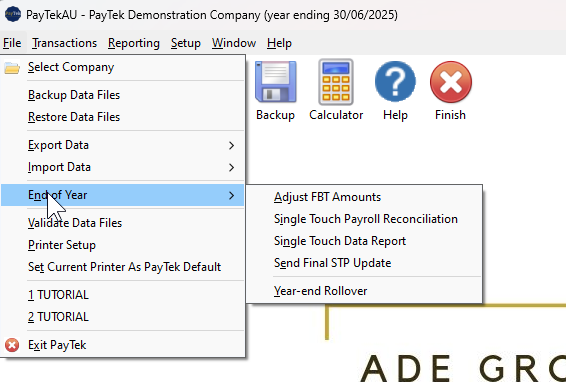

If you neglected to tick the box as the final pay event when sending you last payrun you can send a final update to STP from the EOY menu (see above)

After you have finished the year the single touch data report will show the totals reported for each employee for the year.

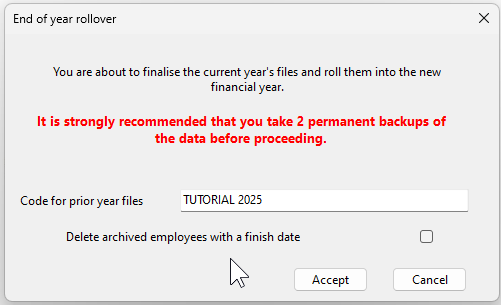

You should then take a permanent backup of the your file (backup to the cloud or onto a usb stick etc) and roll forward to the next financial year. Roll your database forward by selecting File… End Of Year… Year-End Rollover. (This will save a copy of the current year database in your company files list for reference.)

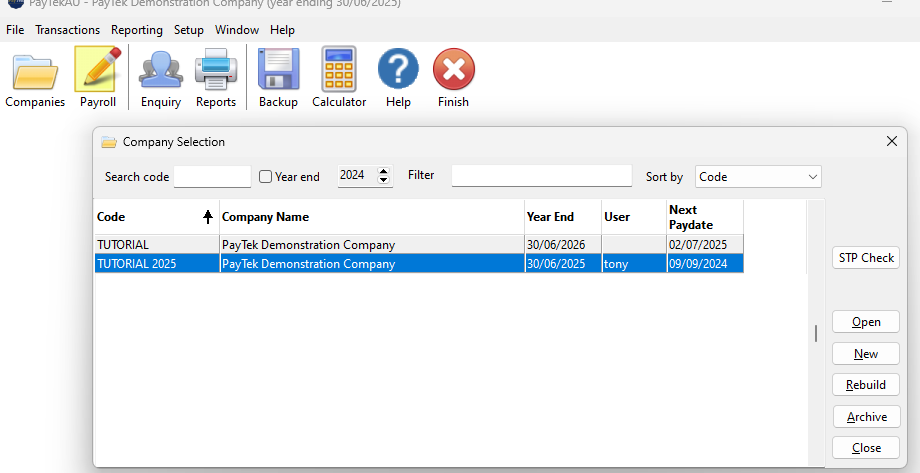

6. After you have finished the rollover you will see the prior year file on your company list and the current company file will be ready to go for the new financial year.

TIP 1: If you discover errors after sending your last final payrun for the year you can either rollback the last payrun, make the corrections then resubmit it as a replacement pay event or process an extra payrun dated 30 June making the corrections.

If you roll back the last payrun you should correct it then finalise it and send it as a pay event as normal (ticking the final box)

If you process an extra payrun, finalise it as an additional payrun (ie do not update any leave accruals) then submit it to single touch. In this case you would tick the “Final pay event for the year” and also tick the box to send it as an Update. An update sends the employee totals only and does not report the Gross amount and Tax amount of the payrun.

Disclaimer: This information is of a generic nature intended to assist in the use of the software. For specific advice regarding your particular circumstances please seek assistance from your Accountant, the Australian Taxation Office or your IT Consultant as appropriate.